Understanding the Bollinger Bands Strategy in Trading

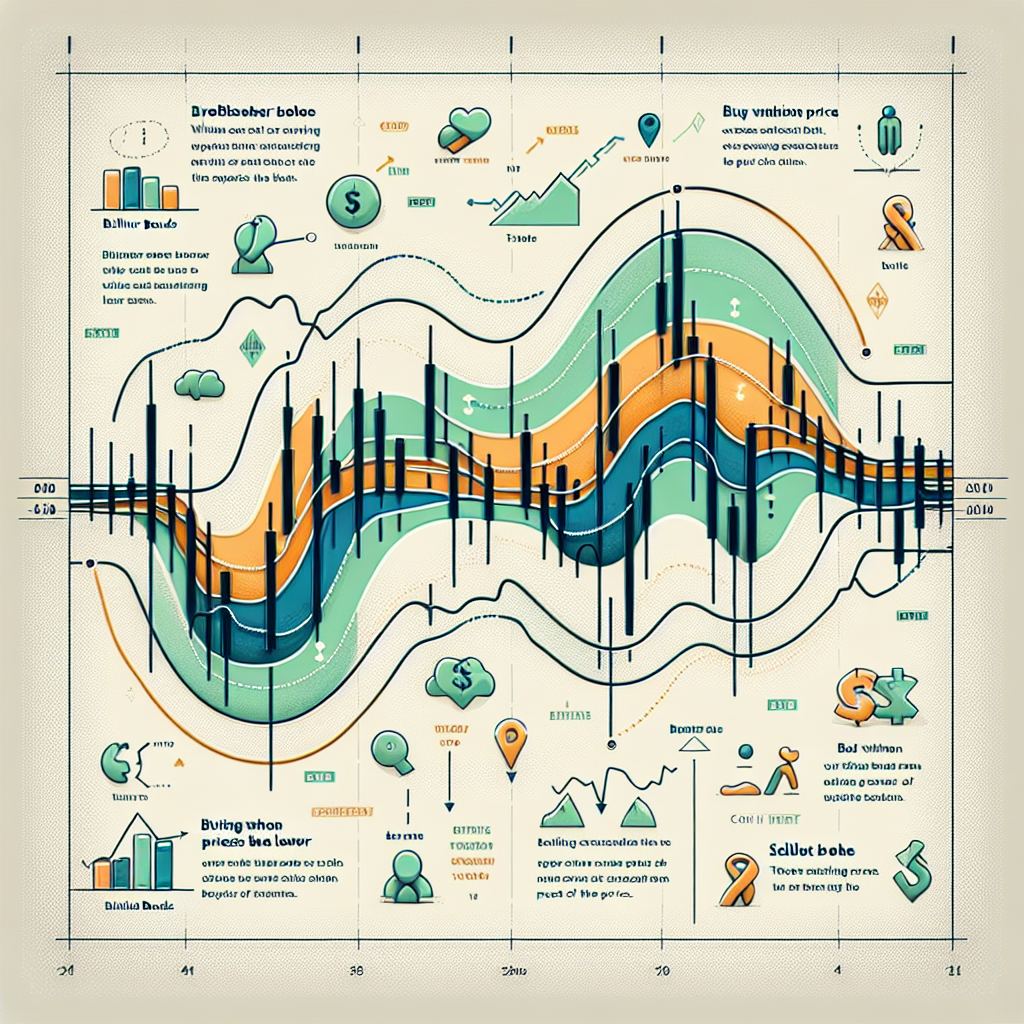

The Bollinger Bands strategy is a widely used technical analysis tool among traders seeking to identify volatility and potential price reversals in financial markets. Created by John Bollinger in the 1980s, this strategy utilizes a set of three lines—the upper band, lower band, and middle moving average—to visually represent the price’s tendency to oscillate. In this comprehensive guide, we will explore what the Bollinger Bands strategy is, how it works, its key components, and several practical trading methods you can implement. We will also cover crucial LSI keywords such as “volatility bands,” “price action,” “trend reversal,” and “technical indicators” to provide a well-rounded understanding.

What Are Bollinger Bands?

Bollinger Bands are a technical analysis indicator consisting of three lines:

- Middle Band: This is usually a 20-period simple moving average (SMA) of the price.

- Upper Band: Calculated by adding a certain number of standard deviations (typically two) to the middle band.

- Lower Band: Calculated by subtracting the same number of standard deviations from the middle band.

These bands expand and contract based on market volatility. When the market is volatile, the bands widen; during low volatility, they contract. This makes Bollinger Bands a popular volatility indicator for identifying periods of high and low price movement.

How Does the Bollinger Bands Strategy Work?

The Bollinger Bands strategy is designed to help traders recognize overbought and oversold market conditions. Here’s how it works:

- Price Touches Upper Band: When the market price touches or moves above the upper band, the asset may be considered overbought, signaling a potential trend reversal or pullback.

- Price Touches Lower Band: When the price touches or moves below the lower band, the asset may be oversold, indicating a possible upward reversal.

- Middle Band Cross: If the price crosses the middle moving average, it can indicate a shift in price trend.

However, it’s important to combine Bollinger Bands with other technical indicators like RSI or MACD for more reliable signals.

Key Concepts and LSI Keywords Related to Bollinger Bands Strategy

To fully grasp the Bollinger Bands trading strategy, you should be familiar with related terms and concepts:

- Volatility Bands: Another term for Bollinger Bands, highlighting their function in showing market volatility.

- Price Action: The movement of an asset’s price, which traders analyze using Bollinger Bands to spot breakouts and reversals.

- Trend Reversal: When an established trend changes direction, often identified by price touching or crossing the bands.

- Technical Indicators: Tools like Bollinger Bands, RSI, and MACD that help traders analyze the market and make decisions.

- Support and Resistance: Bollinger Bands can help identify these levels when price repeatedly bounces off the bands.

- Breakout Strategy: A method where traders enter positions when the price breaks above or below the bands, expecting a strong price move.

Popular Bollinger Bands Trading Strategies

There are several methods to use Bollinger Bands in trading. Below are three widely adopted strategies:

1. Bollinger Bands Squeeze

The Bollinger Bands squeeze occurs when the bands contract tightly around the moving average, signaling reduced volatility. Traders interpret this as a prelude to a significant breakout—either up or down. When the bands begin to widen again, it’s a cue to watch for a strong move in price direction.

2. Reversal Trading with Bollinger Bands

This approach involves entering trades when the price touches the upper or lower band. If the price hits the upper band and starts to fall, it may be a sell signal. Conversely, if the price touches the lower band and rises, it may be a buy signal. Combining this method with candlestick patterns or RSI can improve accuracy.

3. Riding the Trend

During strong trends, the price may “ride” the upper or lower band. In such cases, traders often look for pullbacks towards the middle band as potential entry points in the direction of the trend. This is especially useful in trending markets where price follows momentum.

Advantages and Limitations of the Bollinger Bands Strategy

| Advantages | Limitations |

|---|---|

|

|

Tips for Using Bollinger Bands Effectively

To maximize the effectiveness of the Bollinger Bands trading strategy, consider the following tips:

- Adjust the band settings (number of periods or standard deviations) to suit your trading style and asset volatility.

- Use additional technical indicators like RSI or MACD for confirmation.

- Practice risk management to minimize losses from false breakouts.

- Backtest strategies before using them with real capital.

- Always consider the broader market context and avoid relying solely on one indicator.

Conclusion: Is the Bollinger Bands Strategy Right for You?

The Bollinger Bands strategy remains a fundamental tool for traders seeking to understand price volatility and identify potential trading opportunities. By analyzing price action relative to the bands, you can spot overbought and oversold conditions, anticipate breakouts, and improve your overall trading decisions. However, like all technical analysis methods, it’s best used in combination with other indicators and sound risk management practices. Whether you are a beginner or an experienced trader, mastering the Bollinger Bands strategy can add valuable insight to your trading arsenal.